There are pros and cons of applying for a boat loan with these institutions. On other hand, if the borrower is strong financially and knows that he won't be missing any payments, then go for the secured boat loans.īorrowers can apply for a boat loan with their local bank, credit union, dealership, and online lenders. However, to justify the extra risk, lenders charge a higher interest rate for unsecured boat loans.įor borrowers with a high credit score, unsecured boat loans might be worth a shot. If the borrower doesn't want to lose his boat, he may consider an unsecured boat loan, in which case the lender has no right to take his boat if the borrower defaults. If the borrower stops making payments, the bank or lender would take the boat. However, nobody can predict how the interest rate would go in the future, therefore, it is much safer to lock in a fixed rate.Ī boat loan can be secured or unsecured. The interest rate is lower for secured boat loans, but collateral is required which would be the boat itself. The variable rate is good only when the interest rate is declining. With a variable interest, borrowers usually pay a lower introductory interest rate initially, and then the rate fluctuates based on the interest rate index.

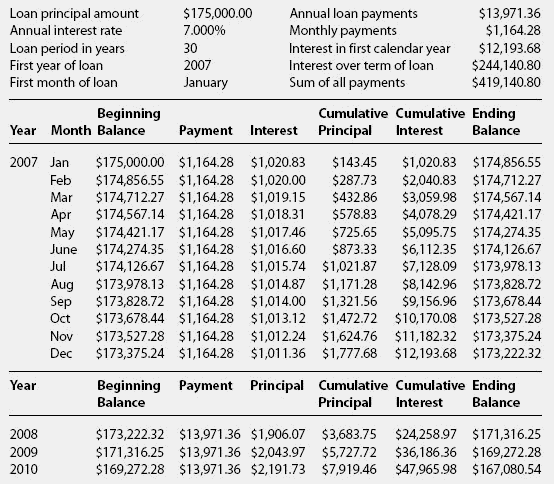

If you have ever financed a car, you know exactly how it works.Ī boat loan can be fixed interest or variable interest, but most people choose a fixed interest as it is safer and gives the borrowers peace of mind.Ī fixed interest rate means the borrower pays the same amount each month. With a longer term, the borrower would pay less each month but would end up paying more in interest, whereas a boat loan with a shorter term means a higher monthly payment but the borrower saves in interest.Ī boat loan works just like a car loan except that the terms are usually longer because boats are more expensive than cars. The typical down payment required by lenders ranges from 10% to 30%.

Higher loan sizes usually require a longer term, but may also come with higher interest and higher down payment. It depends on the lender and the borrower's ability to pay back. The length of the boat loan can be anywhere from 5 to 20 years. Borrowers with a high credit score will get a lower interest rate. The interest rate is determined by one's credit score, the size of the loan, and the terms. Once the borrower is approved for the boat loan, he is required to pay fixed monthly payments until the loan is paid in full. He receives a lump sum payment from the lender to buy a boat he otherwise may not afford, and pay the lender back in installment which is very similar to an auto loan. A boat loan is a loan that a borrower gets to finance the purchase of a boat.

0 kommentar(er)

0 kommentar(er)